Manufacturers are now re-considering their production and supply-chain strategies. “Should we reshore production back to home country?” Or, “should we rightshore – distribute production between the offshored factories, and new, local manufacturing units built near headquarters?” You don’t know which strategy – reshoring, rightshoring, offshoring – is optimal, before you have compared their ROIs! This blog explains how you can define ROI to choose the right production strategy!

Need help with calculations? Download local manufacturing ROI Guide!

Why Are Manufacturers Reshoring and Rightshoring?

In the 1990s and until 2010, offshoring productions to the low-cost Asian countries was a profitable strategy. Now manufacturing salaries in Asia have risen dramatically, and manufacturers are experiencing issues with low quality, high duties and taxes, expensive freight costs, bloated inventories, and long lead times. China’s 2017 National Intelligence Law has increased intellectual property thefts. The rise of continuous global uncertainties, and the pandemic have turned offshoring more risky, and less profitable.

Benefits of Reshoring and Rightshoring

The business case of reshoring and rightshoring sound great. Or, how can you, as manufacturer resist these benefits: tax incentives, better quality, shorter lead times, smaller inventories, while also meeting fluctuating customer demands quickly, easier collaboration, skilled and innovative workers, and IPR protection. Selling locally-made, premium-priced products, eliminating import duties, and reducing transportation costs can increase your profits substantially!

Despite these lucrative benefits, however, reshoring and rightshoring typically require an investment in local manufacturing, and the business case is not so straightforward.

Should You Invest in Local Manufacturing?

It could well be the right strategy for your company, too, but you cannot know it before calculating the Return On Investment (ROI) for a local manufacturing unit.

How to Calculate ROI?

Reshoring and rightshoring are just like any other investment – they must pay back the initial CAPEX costs of the local manufacturing unit, or otherwise, it’s not worth pursuing.

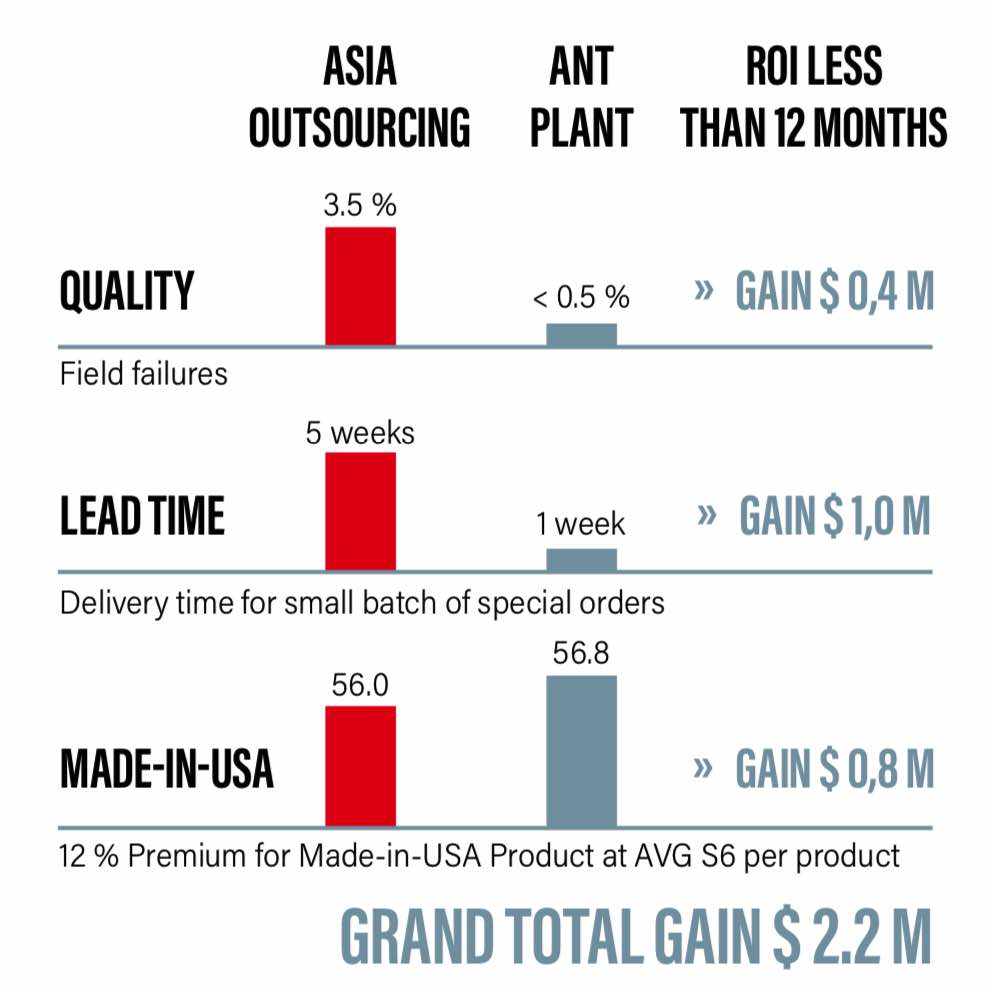

Here’s how to calculate the ROI for local manufacturing to determine if reshoring or rightshoring makes economic sense for your company. The three primary value contributors considered in this example are as follows: 1) Quality, 2) Supply-chain, and 3) Sales.

Picture: Example of ROI Calculation – download the E-Guide for more information.

How Much You Can Gain with Higher Quality?

One of the biggest offshoring disappointments has been low product quality, which increases manufacturers’ costs in many ways – through customer reclamations, re-production, waste, and lost sales.

By estimating how much you lose money annually due to the issues of poor quality, you can estimate your potential savings in the reshoring and rightshoring scenario.

For example, a LED tube manufacturer with an annual production capacity of one million units, could reduce the share of faulty units from 3.5 percent to 0.5 percent – by moving production from a Chinese factory to a fully-automated micro-factory in the US.

How a Shorter Supply Chain Saves You Money?

The shortest supply chain goes from local robots to customers! A streamlined supply chain is a crucial benefit in rightshoring. It saves money because of the lower working capital.

In the case of the LED tube manufacturer, the delivery time was reduced from 5 weeks to 1 week by radically streamlining the supply chain.

You can stack up savings from various sources: reduced logistics costs, shorter lead times, more accurate forecasting, better flexibility, smaller inventories, and reduced waste and obsoletion. Then it is easy to estimate how much the shorter supply chain would reduce your costs in the reshoring and rightshoring case!

How Much Can You Increase Sales?

As a local manufacturer, you can tag a Made in USA or Made in Europe label on your products. Depending on the sector, the selling price for domestic products can be as high as double compared to imported products.

Even in the commoditized LED tube market, the price of a local product was estimated to be 12 percent higher compared to Chinese products. Additionally, domestic products can sometimes open you to the public procurement markets.

The higher sales revenue potential can justify a part of the reshoring and rightshoring investment – you just need to estimate a price tag for this benefit to determine ROI!

Research: 52% Manufacturers Chose Rightshoring!

A survey by the University of Warwick, found that only 13% of companies have directly reshored all their operations. However, even 52% of the manufacturers had chosen rightshoring production. So, instead of full-reshoring, they have invested in local manufacturing, and split production between the existing offshored factories, and the new local microfactory unit!

A smart rightshoring strategy can generate your company positive economic net-value and deliver a competitive advantage in the long-term. You just need to define the best operational model for your company – and calculate ROI for it!

Do you need help in calculating ROI for local manufacturing? Download our e-Guide!

EID Robotics can help you in assessing the right supply chain for you, determine ROI, and plan ahead an agile, local micro-factory for you! Contact us and let’s talk!